Is VeChain a Good Investment? I Think So!

What is VeChain? Is VeChain a Good Investment? Should I Invest in VeChain?

Are you in need of an answer to any of the above questions? Well, you have come to the right place. In this article, I will be discussing VeChain in detail and give you My Opinion on Whether VeChain is a Good Investment Opportunity or Not.

An original VeChain homepage is in Chinese because their core team is from China.

VeChain Review

Name: VeChain

Launched: 2017

Type: Cryptocurrency

Short Review: VeChain forms the leading blockchain platform for products and information. VeChain uses the blockchain technology to create a trust free distributed business ecosystem. VeChain has made the management, collection, and sharing of product information with consumers and vendors secure and straightforward. It is designed for companies such as luxury goods, logistics, food/drug, agriculture, and governments.

It will be exciting to see how VeChain project moves forward in the future. The project looks promising but nothing is 100% sure in the world of cryptocurrencies. If you want to minimize your risk and maximize your profits, take Roope’s cryptocurrency training for a 95% discount.

If you prefer more secure ways for earning money online, I recommend following this step-by-step training.

What Is VeChain?

VeChain is a Blockchain-as-a-service company with the goal of building “a distributed and trust free business ecosystem to facilitate a transparent flow of information, high-speed transfer of value and efficient collaboration. The project has been in operation for two years and a number of companies have adopted it.

There is a lot that a company can do with VeChain. One can use the technology to track items through a supply chain, ensure quality and authenticity of goods and control the quality of food products.

How Does VeChain Work? / Benefits of VeChain

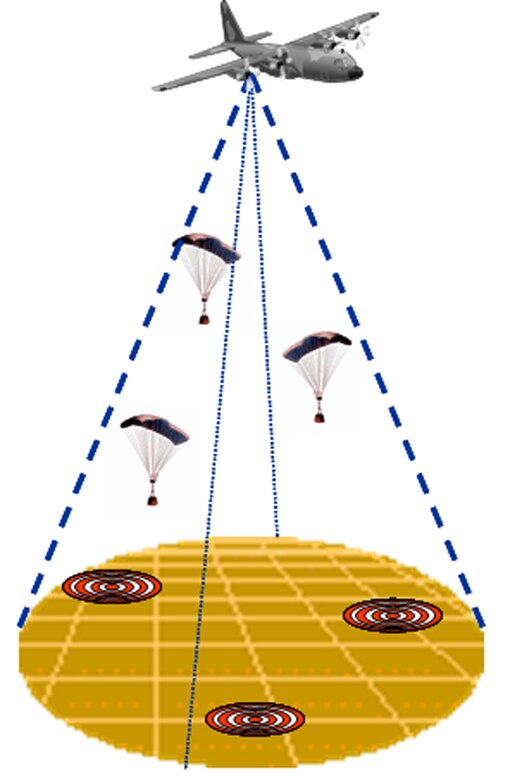

VeChain was primarily started as a supply chain company but it has announced that there are plans to transform it into a Dapp platform. VeChain mixes the blockchain and smart chip technologies for tracking items throughout their entire lifecycle. There are different IoT (Internet of Things) items on which the smart chip can be integrated including QR codes, RFID trackers, and NFC chips.

This may not sound like an interesting technology, but it ensures that companies produce quality products. A good example is the luxury goods sector. This industry has been wrought with counterfeit goods worth over $450 billion.

For an item such as Louis Vuitton purse changing hands numerous times during production and distribution processes, there is a need for you to be sure the person before you passes what is authentic. VeChain has done away with the need for this trust. At each step of the process, it is possible for you to scan a smart chip on every item in order to be guaranteed you are receiving what you should be receiving.

The blockchain is in the form of an immaculate ledger, hence you can stay assured the information you receive is accurate. This technology may soon get into consumer’s hands and they will be able to check the authenticity of items by scanning them with their phone.

Other than protection against counterfeits, VeChain helps in improving logistics systems via simplified product tracking. Logistics is a complex process that involves different systems across businesses. This can make tracking products in a supply chain a complex process. This even becomes harder when there is a need for switching between processes or when the data must be entered manually.

When using VeChain, you are only expected to scan the smart chip of the item and you will get all of its details. This way, businesses can get accurate and updated information about an item. When integrated with IoT, VeChain can help in quality control. This is very useful in the food and agricultural industry in which something such as temperature change of few degrees may ruin an entire product batch.

Risks of VeChain

Despite the potential that the VeChain has, it faces a number of challenges. When you consider the state of logistics in the world today, a lot of growth is expected to happen. This means that we may observe a lot of adoption of this technology some years to come.

However, as it is now, it is less likely that there will be a high adoption of the VeChain technology in the coming 12 to 24 months. The adoption of this technology in most businesses may only be some years to come when a number of players will be using the chain. However, this may not be necessarily a problem but an advantage to those who adopt the technology early.

=> Does VeChain Feel Too Risky? Why Wouldn’t You Learn a PROVEN Way to Make Money Online?

VeChain Team

The company behind VeChain is based in Singapore and it has used the blockchain technology to implement the VeChain. The project has attracted an international team of experts drawn from various fields including technology, operations, the blockchain, business, and support. The group currently has 150 employees.

The team is led by Sunny Lu who is the CEO and a fluent English speaker with a great experience in IT and Information security for luxury retails brands. He formerly worked with Louis Vuitton China as a CIO and IS&T Director. Jie Zhang is the CGO while Bo Shen is the company advisor.

Below are the key members of the VeChain team:

- Sunny Lu- The Project Leader

- Richard Fu- The PR and Marketing Director

- Chin Qian- The Channel and Sales Director

- Jay Zhang- The Finance Director

- Scott Brsbin- The General Counsel

- Jerome Grilleres- A Business Developer

VeChain Community

As part of expanding the VeCain community, the team has entered into partnerships with big companies in the world such as DNV GL and PwC. VeChain takes part in the PwC incubator program which gives it access to the worldwide network of clients for the company. Its partnership with DNV GL will also open a great door for it to reach many clients.

The Chinese government has also chosen VeChain as the blockchain technology partner for the government of Gui’an. This government runs under regulations which are expected to contribute significantly to the growth of VeChain.

You can also find VeChain on the following social media networks:

- Facebook – 6,5 members in their group

- Twitter- Their page has over 73,000 followers.

- Telegram +20k members

- Their SubReddit is active daily with discussions sprouting up every minute.

Is VEN Worth Buying?

Similarly to the other blockchain projects, you must be wondering about the future of the VeChain blockchain. The project will be rebranded soon to become VeChain Thor blockchain. The VeChain token, that is, VEN, is expected to be rebranded to VET. A proof-of-authority consensus model will also be introduced to ensure any changes made are in line with VeChain vision.

These changes are expected to impact the project positively. If this happens, it will lead to a MASSIVE adoption of the technology, and the value of its coin will rise. I will advise anyone to buy this coin.

Most blockchain projects are currently simply a proof of concept. However, with VeChain, things are different and in a good way. Three products have already been developed by use of this blockchain and they are all targeting different markets. This means the team is serious with the project.

VEN Price Prediction

The VeChain has been designed to run on Ethereum platform and it is powered by its own token known as VEN/VET. After rebranding of the VeChain, all the existing VEN tokens will be exchanged for VET tokens. The token is now priced at USD5.367 with a market cap of USD1, 713, 081, 262. A total of 277 million tokens is now under supply.

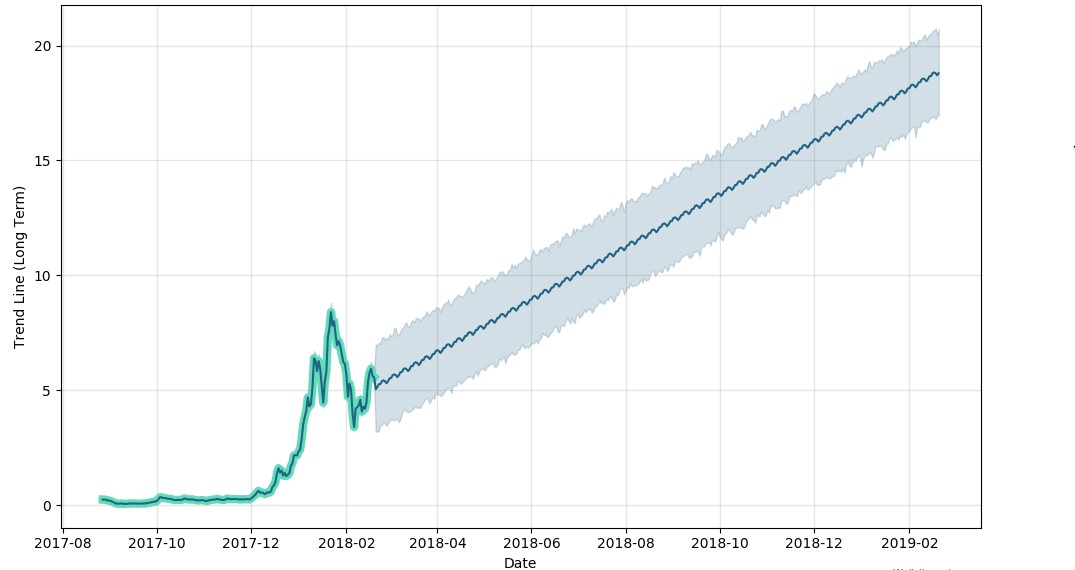

If you need to invest in a profitable cryptocurrency, VEN might be an interesting option for you. An optimistic prediction shows the following picture that you can see below (of course, it’s a bit of a joke 😉 )

Will VeChain go to the moon?

We could again say the cliche, “Do your own research!” but I think a better way to educate yourself about cryptocurrencies here so you will spot whether VeChain will be a winner or not.

Where to Buy VEN Tokens?

Binance is the best exchange from which you can buy VEN tokens. If you have Ethereum or Bitcoin cryptocurrencies, then you can exchange them for VEN. This means before buying VEN tokens, you should first buy bitcoins or Eth from exchanges such as Coinbase, GDAX and Gemini.

After acquiring the bitcoins or Eth, you can transfer them to Binance exchange on which you can trade them for VEN tokens. Below are other exchanges from which you can buy VEN tokens:

- BigOne

- HitBTC

- Liqui

- Lbank and QRYPTOS.

Where to Store VEN?

Currently, you can only store VEN in a wallet with an ERC20 support. A good example is MyEtherWallet which has a good community trust.

To get an extra security layer, use a hardware wallet such as Ledger Nano S. This is an offline wallet that can be connected to MyEtherWallet for storage of funds. Below are other desktop wallets in which you can store your VEN tokens:

- Trezor Hardware Wallet (Recommended way of storing)

- Ethereum Mist DApp

- MetaMask

Conclusion – Is VeChain a Good Investment?

VeChain is now amongst the established blockchain companies in the world. Their team is made up of professionals with experience in their target industry. They have also partnered with the Chinese government and giant companies like PwC, meaning that they have no problem with growing their clientele.

If VeChain continues with its current pace, you will see it become one of the best performers in the cryptocurrency world.

That being said, you always need to take the responsibility for your investment and make sure that you have studied all the details diligently. For those of you who prefer building a sustainable and a profitable online business, I recommend having a look at the training below.

It will also help you to make more money with cryptocurrencies.

What do you think about VeChain?

Does it have a bright future?

Would you Invest in VeChain?

I Will Be Happy to Hear your Genuine Opinion about VeChain!

Let’s discuss in the comments below! 🙂

(Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice.)

“Is Hshare/Hcash a good investment?” I Believe So!

What is Hshare? How does it work? Is Hshare a good Investment? How much should I Invest in Hshare?

If you have not been getting answers to the above questions, you have come to the right place. In this article, I will be unearthing everything about Hshare. Read this article to know the potential of this project as well as the risks associated with it.

Hshare/Hcash Homepage

Hshare Review

Name: Hshare

Launched: 2017

Type: Cryptocurrency

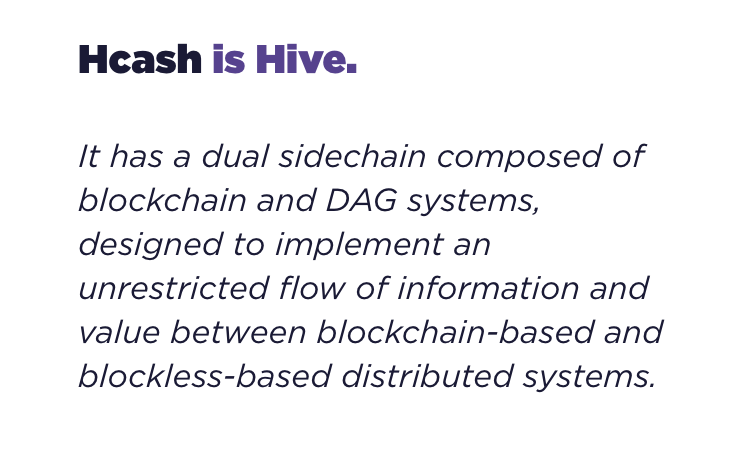

Short Review: Blockchains can be either block-based or blockless-based. It has been impossible to transfer value between these two different types of platforms. Hshare changed this through facilitating transfer of value and information between these different platforms.

Are you looking for a way to earn money online? Continue reading this article to know how you can make it with Hshare.

But before we move on, I want to remind you that investing in Hshare or any other cryptocurrency involves also great risks. If you prefer proven and guaranteed ways to earn money online, I recommend following this step-by-step training.

What Is Hshare?

Let me show first how the company defines themselves. I’ll then explain you more in detail what it means.

Most companies are now adopting the blockchain technology as a way of increasing efficiency and cutting costs. Hshare is a cryptocurrency designed to facilitate the transfer of value among blockchains and between blockchain and blockless cryptocurrencies.

How Does Hshare Work? / Benefits of Hshare

Consider the example of Bitcoin and Ethereum blockchains. There is no way the two can talk to each other. For you to transfer value from one to the other, you must use an exchange. The number of independent blockchains is increasing every day, making the problem of transfer of value between blockchains bigger.

When using exchange services, you face the challenges of speed and transaction fees. Below are reasons why Hshare is the future cryptocurrency

- Hshare is Secure and Private

This has been achieved by adapting the by adapting the zero-knowledge proof technology. A user is allowed to disclose some details of a transactions to a verifier without necessarily having to reveal his/her identity. It also used uses both proof of work (PoW) and proof of stake (PoS) algorithms for verification of transactions, which in turn engages user engagement.

- It is bi-directional

This is a unique and lucrative feature of Hshare that has left many individuals and companies hail it as the cryptocurrency to watch. It has both blockchain and DAG (directed acyclic graphs) that allow it to transfer value between blockchain-based and blockless-based systems. This feature will make it possible for cryptocurrencies to interact with each other without relying on an exchange.

Hshare wants to allow the communication between different blockchains.

- Hshare is Quantum resistant

Quantum computers are capable of existing in another state other than 0 and 1. These are very powerful computers capable of cracking a code for any system including a blockchain. However, Hshare developers put this into consideration but using a code that is quantum resistant. The Hshare cryptocurrency cannot be hacked using a quantum computer.

- It is hierarchical

Hshare has a hierarchy that makes it easy to make decisions regarding the future of the cryptocurrency. A user’s voting power does not depend only on their stake but also on the amount of computing power they have contributed to the system. This provides the system with a stable base that can be used for making improvements in the future.

Challenges of Hshare – Is Hshare a Scam?

Despite the many advantages of Hshare, the technology is faced with a number of challenges that it must handle. The way it handles these challenges will determine whether it succeeds or whether it fails. That said, I want to discuss the challenges that the Hshare team must tackle when moving forward:

Since the release of Hshare, it has been a target of criticism especially after climbing the CoinMarketCap to its top spots. Some of its critics have even called it a scam coin, stating that the team under its development are not ready to implement what they have described in their whitepaper. The whitepaper states many technologies without describing how they will be implemented into one system.

Currently, no one can guarantee cryptocurrency enthusiasts that Hshare is under active development. Only 17 commits from a single contributor have been witnessed for the past 5 months on the Hshare Github.

However, we may have development of the platform going on somewhere offline, but Github has been the best platform for open source projects like Hshare, and seen very little activity regarding the same makes us raise eyebrows.

The Hshare team has also not created a LinkedIn account, and they are missing user history on common social media platforms.

=> Want to See How Roope Lost $15,000 with Cryptocurrencies in a Single Day? Learn More Here!

However, all the above issues facing Hshare might be caused by the fact that the team is based in China in which there are restrictions regarding access to some of these sites. If you can speak Chinese, you may be able to get more details regarding this team. The internet has remained silent when it comes to verification of the Hshare team’s credentials.

Despite the above odds, Hshare has a bright future in which blockchains will be connected and it will be possible to transfer value between various platforms. It is not clear what the development team is doing and the progress they have made so far.

Hshare Team

Dallas Brooks is known to be the CEO overseen the development of Hshare. He is a qualified and experienced expert in the financial and investment industry. He has an in-depth knowledge about the financial world and he is ready and willing to revolutionize it. He has been working on finding the best cryptocurrency to facilitate communication between various blockchain implementations.

Hshare team leaders.

Brooks hosts a television show named “Dollars with Sense”, in which he educates people about financial and legal matters. His vision and entrepreneurship is expected to take Hshare to another level. Khal Achkar is known to be the CTO of Hshare. He has an extensive knowledge about information systems and how they can be implemented.

Achkar has a great interest in the blockchain technology, and this is expected to drive the growth of Hshare. The team has a total of 7 team members with an age averaging to 45 years. The Hshare team details can be summarized as follows:

- CEO: Dallas Brooks

- CTO: Khal Achkar

- Team Members: 7

- Average team Members Age: 45 years

Other members of the Hshare team include Dawu Gu, a Computer Science Professor from Shanghai Jiao Tong University leading the cryptography and information security research team, Ryan Xu, the Managing Director of Collinstar Capital and Dr. Joseph Liu, a cybersecurity expert.

Hshare Community

The following are the statistics about the number of followers Hshare has attracted on various social media accounts:

- Twitter: 3,908

- Facebook: 1,416

The Hshare can be found on Twitter and Facebook. Their Facebook account was created on June, 2017, and it has attracted 1,416 likes so far. They have a blog on which they post on a weekly basis.

Is Hshare Worth Buying?

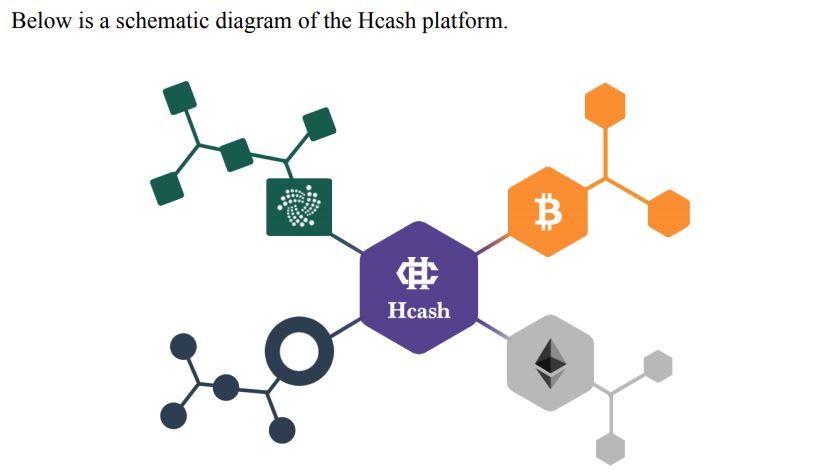

Personally, I think this is a cryptocurrency worth buying. The current market capitalization of this currency, whose native cryptocurrency trades under symbol HSR, stands at ~$450 million with the price currently standing at around $10. This price is expected to rise steadily in 2018 but of course estimates vary significantly depending on who you ask.

Hcash was launched in the Autumn of 2017.

Cryptocurrency users have wanted a way of moving from one cryptocurrency to another with much ease and at no or lower cost. Companies also need a way to communicate from one blockchain to another, example, from Ethereum to Bitcoin. Since Hshare supports this, it is expected that individuals and companies will adopt it at a high rate, increasing its value.

I believe the best time to buy Hshare is now. If they succeed in implementing what is stated in its whitepaper, the market cap for this cryptocurrency will rise, even 100x. This may take a long time, but it is still possible.

Note: The price of Hshare varies highly like with other cryptocurrencies. The price went from over $17 to less than $10 during the writing of this article.

Hshare Price Prediction

Hshare is one of the new cryptocurrencies in the market released in 2017, so it hasn’t stayed in the market for more than one year. However, despite the short stay in the market, the dynamic movement of the price of this cryptocurrency has lit the market.

After the first listing of HSR, it was selling at $20 per token. The value of this coin hit $36 within a month, which is an 80% increase. This made many cryptocurrency lovers prepare to invest in this coin, but its price went down t0 6.56% within 5 days. The coin’s price went down further to $4.64 within 9 days.

However, the crypto-coin gained its force, with its price beginning to rise from 15 September 2017. By mid-December, its price was about $40. However, the value has gone down and the price now stands at about $10.

However, I believe that many individuals are to adopt this coin after learning its benefits, and this will cause its price to increase. If you want to learn how to make more money with cryptocurrencies, I recommend following Roope’s step-by-step training here.

Conclusion – Is Hshare a Good Investment?

Some investors may disagree, but I believe that Hshare is one of the cryptocurrencies one should trade. Trading a cryptocurrency that maintains a single trend for over six months is not advisable. Hshare has not shown this trend.

Hshare market varies from time to time, which gives traders to place different trades based on their predictions. This way, the traders may earn profits regularly. However, to trade Hshare, I recommend that you use indicators such as Elliot waves to know the direction the price may go.

As always, I want to remind that investing in cryptocurrencies can give great returns but it also involves risks. You need to be prepared for losses as well. Don’t put your whole fortune in the game unless you really know what you are doing.

For those who prefer more secure and risk-free ways to make money online, I can highly recommend checking out a powerful step-by-step training by clicking here or the picture below. It will also help you to make more money with cryptocurrencies.

What are your thoughts about Hshare?

Do you think it is a good investment opportunity?

What can you say about the future of Hshare?

I Will be Happy to Read your Opinion in the Comments Below!

(Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice.)

Maker Token Review (MKR) – Can You Make Money?

In my last article, I reviewed the DAI stablecoin. The Maker Token (MKR) is a stellar example of a functional token. The token holders govern the Maker system and their actions affect the price of MKR. Read on to discover more.

Maker Coin Review – Will Maker Hit $4,000 in 2019?

Take a look at my YouTube video to learn more about Maker.

Maker Review

Name: Maker

Ticker: MKR

Launched: 23th August 2015

Type: Cryptocurrency, ERC-20 token

Short Review: The Maker Coin (or Maker Token) is an investment into the Maker Project. Ownership of MKR permits taking part in the maintenance of the Maker projects, like the stablecoin DAI and the ecosystem around it. The value of MKR is based on the successful maintenance of the projects and use of the products.

Maker is an interesting token and may give great returns in the future if Dai/MKR projects succeed. On the other hand, investing in cryptocurrencies always involves risk. If you want to learn a more secure way to earn money online, have a look at this step-by-step training.

What Is Maker and How Does It Work?

What Is Maker and How Does It Work?

In a previous article, I explained the DAI stablecoin, valued at 1 USD. I recommend reading that article first, or the terminology used here might be confusing. The parameters for DAI generation are set by holders of the MKR token via vote. The parameters include but are not limited to:

1. Target Price

The target price of DAI is currently set at 1 USD.

2. Target Rate Feedback Mechanism

MKR holders vote on the Target Rate and the Sensitivity Parameter. They can also disable TRFM altogether, keeping the Target Price locked.

3. Risk Parameters

The Risk Parameters for the currently available CDP is set at 150% collateral for every DAI generated. The MKR holders can vote to allow users to create more risky CDPs (less collateral per DAI) or alternatively require more collateral per DAI. The Risk Parameters also include the fees users pay when their CDP is closed due to prices dropping or paying off the loan.

4. Global Settlers

MKR holders appoint and determine how many persons are required to trigger a Global Settlement, a last-resort stability mechanism, for the Maker Platform.

Benefits of Maker

What is the benefit of owning MKR? How will the price go up?

1. Closing CDPs destroys MKR

When a user closes a CDP by destroying an amount of DAI equal to the amount they created using it, they have to pay a small interest fee issued in MKR. This MKR is destroyed, thus reducing the supply of MKR and increasing its price.

As the demand for the DAI stablecoin increases, users keep creating new CDPs and eventually close them to regain their collateral. The more popular DAI becomes, the more MKR is destroyed as interest fees, increasing the price of MKR.

2. Floating price on exchanges

MKR is an ERC-20 token that can be traded on exchanges. Like most tokens, the price of MKR floats according to supply and demand. This makes MKR a viable long-term investment, unlike DAI.

Risks of MKR

There are also mechanisms that cause the value of MKR to drop.

1. Automatic recapitalization

If the collective collateral pool becomes less valuable at some point than the total amount of DAI in circulation, the system creates new MKR and sells it to fill the collateral pool. This dilutes the supply of circulating MKR, decreasing its price. Ultimately this means that the MKR holders are responsible for keeping DAI sufficiently backed and have to pay if it becomes undercollateralized.

2. Hacking

Even though the project is over 2 years in making, they still list malicious attacks on their smart contracts as the primary threat to the system. The project aims to combat this via external security audits and formal verification of the smart contract code. Looking at the roadmap and other ongoing work, this does indeed seem to be the case.

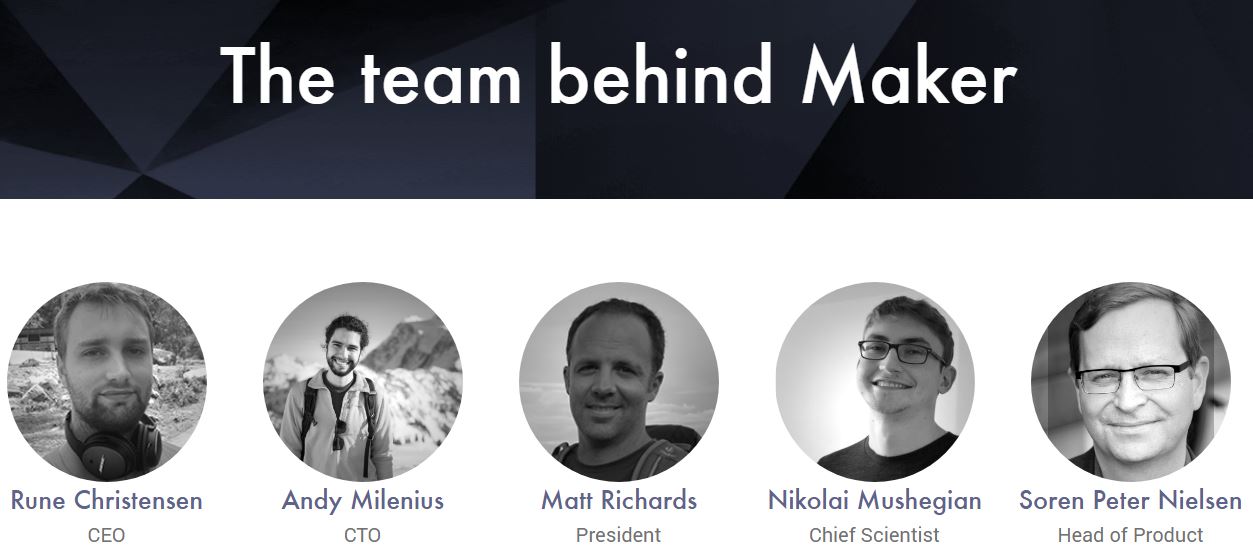

Maker Team

There are 44 people currently working on the MKR project. The sizeable team has done a good job with transparency. They hold weekly voice calls with MKR holders to describe progress and debate changes. In the picture below you can see the leaders of Maker team.

Maker Community

Reddit: 3k

Twitter: 6k

Rocketchat: 3k

The community is active and a significant fraction of it is interested in the development and maintenance of the product. This token is highly technical and as such the userbase would seem to attract blockchain experts and veteran investors.

Is MKR Worth Buying?

DAI was released in December 2017. The price of MKR has almost doubled since then. We can expect a significant increase in users when multi-currency CDPs become available. If more cryptocurrency exchanges begin to use DAI instead of Tether like the Bibox exchange has already done, MKR will benefit.

Maker Price Prediction 2018?

I predict mostly speculative price action for MKR in 2018. The current CDP volumes, while significant, are not enough to affect the price of MKR. That said, I predict that the FUD surrounding Tether will benefit DAI and MKR. Additionally, huge news like a major exchange listing can spike the price up. Finally, MKR benefits from any bullish trends in ETH.

2018: Short periods of 1500$ – 2000$ price range, unable to break 2000$.

2019: Overthrowing Tether combined with bullish ETH for 4000$-5000$, otherwise steady growth towards 3000$

Conclusion – Is MKR a Good Investment?

MKR is an exceptionally complex and risky token. Overthrowing Tether as the leading stable cryptocurrency is a gargantuan task, but the solid technology behind the project makes this a viable goal. Unlike many other tokens, whose value is mostly speculative, MKR has a ready product (DAI) and a clear, transparent system in place connecting the investor token with the product.

I see MKR as a reliable investment even at the current quite high price. However, even more so than usual, I urge you to understand this complex token before investing in it. Staying up to date with the project and predicting major releases by participating in the weekly calls will allow you to stay ahead of the game and move before the market does on MKR.

This token is especially good for purchasing dips. If bad news like hacking or a Global Settlement happens, the price can drop a lot, only to recover later due to the stable demand for DAI generation.

(Note by Roope):

Maker is certainly an interesting cryptocurrency and I consider investing in it in the future. I think that stablecoins are a great step forward when moving into mass adoption of cryptocurrencies. Many people want that the value is predictable and doesn’t move up and down 20% in a day.

That’s why I believe that coins like Dai and Tether may have a great future. It means also that MKR could potentially go up significantly in value.

I am holding the most of my money in cryptocurrencies and they have given me great returns over the years. If you want to learn how I make money with cryptocurrencies, take a look at my step-by-step course on Udemy. I share it for 95% for my website visitors and social media followers.

While I am holding cryptocurrencies, I am building additional income streams with affiliate marketing. If you would like to enlarge your online income or cryptocurrency portfolio, take a look at the step-by-step training below that has took me from a complete beginner into a professional affiliate marketer.

You can also use those steps for making more money with cryptocurrencies.

What do you think about MKR?

Do you think exchanges will move from Tether to DAI?

Do you think hacking is a risk for tech-heavy projects like MKR?

Is MKR worth buying or not?

How much will the value be in the future?

Let’s discuss in the comments below! 🙂

(Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice.)

DAI, a Tether-Killer Stablecoin. Real Stability, No Arbitrary Printing.

Normally the cryptocurrency articles here cover potential investments. DAI, however, stays firmly priced at 1 USD. What makes it so special, then? DAI is the first decentralized stablecoin and also the first one that has legitimate backing. Read on to find out how.

Is Dai Legit? – My Video Review

DAI Stablecoin Review

Name: Dai

Launched: 17th December 2017

Type: ERC-20 token, price stable at 1 USD

Short Review: DAI is an ERC-20 token built upon a complex, decentralized backing system that ensures its price is fixed at 1 USD. Anyone can create new DAI by locking cryptocurrency within a smart contract. The cryptocurrency can be freed by paying the same amount of DAI and a small interest. DAI possesses the most robust technology out of all current stablecoins, avoiding the pitfalls of Tether.

You can use Dai to make more money with cryptocurrencies if you can predict market movements well..

What Is Dai?

DAI is the primary product of the Maker/DAO Project. The online Maker Platform allows users to create new DAI by locking cryptocurrencies in their smart contract as collateral used to back up the stability of DAI. The Maker platform has many means available to keep the price of DAI stable. Currently, the price of DAI is 1 USD and every DAI is backed by at least 1.5 USD worth of Ethereum.

Dai Whitepaper starts by simply explaining why we need it.

The price of cryptocurrencies go quickly up and down so stablecoins like Dai and Tether want to provide an opportunity where you can hold your cryptocurencies in a stable way instead of transferring your money into fiat currencies.

How Does Dai Work?

There are multiple mechanisms in place to keep the price of DAI stable. Here I will briefly go through them all.

1. Collateralized Debt Position (CDP) Smart Contracts

To create new DAI, a user must send cryptocurrency into a special smart contract using the Maker platform. Currently, only Ethereum is supported (Dai v. 1.0), but later versions during 2018 aim to allow other cryptocurrencies as well, like Bitcoin or Bitcoin Cash.

Within the smart contract, the cryptocurrency can be converted (or “wrapped”) into an ERC-20 token, which allows it to be used within the Maker platform. The ERC-20 token corresponding to Etherum is “Wrapped Ethereum”, ticker W-ETH. W-ETH has used on its own: in addition to its use on the Maker platform, it can be traded for other tokens on two exchanges: Oasis DEX and Radar Relay. Later when other cryptocurrencies can be wrapped as well, those exchanges will see much more traffic.

Within the Maker platform, W-ETH can be deposited into the collective cryptocurrency pool that backs the DAI stablecoin. This turns the W-ETH into P-ETH (“Pooled Ethereum”). The P-ETH token denotes the holder’s share of the whole collateral pool within the system.

P-ETH can be “locked” by creating a CDP within the Maker system. This allows for the creation of new DAI. The user can “draw” new DAI from a CDP up to 2/3 of the value of the P-ETH locked within the CDP. Managing CDPs is kind of complicated, but it boils down to 1) If the value of ETH goes up, the CDP can be used to create more DAI. 2) If the value of ETH goes down so much that the locked P-ETH is worth less than 150% of the amount of DAI drawn, the system automatically sells some or all your P-ETH to cover the debt and a penalty fee.

2. Target Rate Feedback Mechanism (TRFM)

The Target Price of DAI is currently set at 1 USD. If the price of DAI on exchanges changes from that amount, the Target Rate Feedback Mechanism activates.

If the price of DAI rises above 1 USD, TRFM activates, causing generation of DAI with P-ETH become less expensive (less collateral needed to generate new DAI). This encourages a generation of new DAI, thus increasing supply and decreasing the price of DAI back to the target price of 1 USD.

Vice versa if the price drops below 1 USD, TRFM causes generation of DAI to become more expensive (more collateral needed to generate new DAI). This causes the circulating supply of DAI to diminish as people hold the coins waiting for the price to increase instead of generating new DAI, causing the price to rise.

The parameters for activating TRFM, that is, how much the price needs to drop or rise for the mechanism to activate, are set by the owners of the Maker Token (MKR). I will write an article on MRK in a few days.

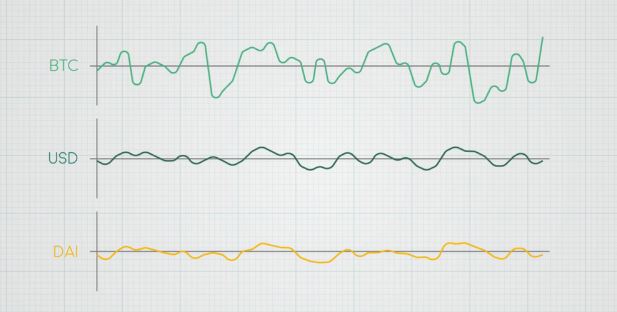

Dai holds the same price with USD and therefore is not a volatile cryptocurrency like Bitcoin.

3. Global Settlement

This is the dramatic last-resort mechanism used to guarantee the target price of 1 USD.

A group of people elected by the Maker Token holders can initiate a global settlement, but activating it without a good cause hurts the value of their own holdings (more on this in the upcoming MKR article). Good causes include strong external price manipulation, a rapid (more than 33%) drop of the value of ETH or technical upgrades to the system.

When a Global Settlement is called, the price of ETH is frozen in place, and CDPs cannot be utilized in any way until the Global Settlement is over. Every CDP owner and DAI holder can withdraw ETH from the Maker platform equal to the value of their W-ETH, P-ETH, and DAI at the time when Global Settlement was initiated. There is no time limit for this. The Global Settlement essentially guarantees the price of DAI at 1 USD in times of crisis via freezing all assets inside the system.

Risks of DAI

1. Tether

Why would people use a complex system like DAI when they can use a more widely-used stablecoin, the USD Tether (USDT)?

There is a minor and a major reason for that. The Maker platform allows for leveraged investing in ETH via the CDP system in a completely decentralized environment, which is a new, original idea. The DAI token hence provides more utility than only the stability.

The major reason for using DAI over USDT is transparency.

Only an unknown fraction of USDT is backed by existing assets. Its value is mostly tied to widespread use. If the trust in Tether is broken, causing a bank run, investors will lose money. Meanwhile, DAI is over-backed (150%) and has multiple systems set in place to guarantee that owners of DAI can convert their DAI to dollars themselves if they wish to do so.

2. Hacking

As an ERC-20 token-based system, the Maker platform shares possible vulnerabilities with Ethereum. The code will be fully reviewed by external auditors in the future according to the project roadmap.

Dai Team

The DAI coin runs mostly on an automated, decentralized system. It is overseen by owners of the MKR token, called Makers. More on this in the MKR token review, released in a few days.

Dai Community

Reddit: 3k

Twitter: 6k

Is DAI Worth Buying?

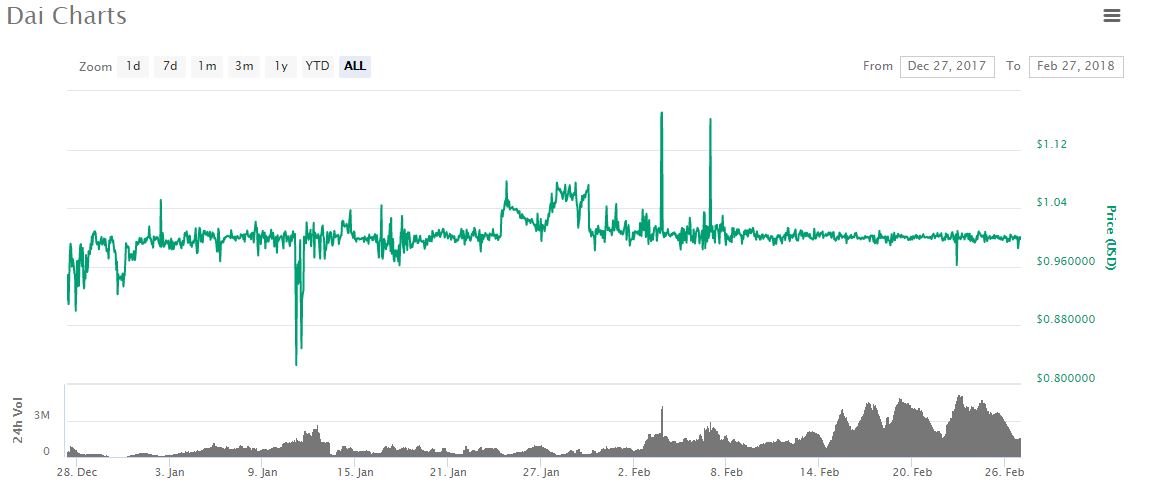

The price of Dai is alwasy supposed to stay at $1. Its highest point was ~$1,10 and the lowest price $0,85 momentarily but it always comes back to $1.

As a stablecoin, DAI is very much alike Tether in its uses. Check out Roope’s review of Tether here.

DAI is less widely used for trading than USDT. At the time of writing this, only a few decentralized exchanges like ForkDelta, IDEX, Radar Relay or OasisDEX (The Maker Platform’s own DEX) and a single centralized exchange (Bibox) had DAI trading pairs.

On the other hand, DAI is much safer than Tether in the rare Black Swan event of Tether collapsing. If Tether would crash, it could attract more users to DAI, which in turn would boost its development and grossly increase the price of the Maker coin, MKR.

Additionally, the CDPs on the Maker Platform can be used to do leveraged purchases of ETH. That is an advanced, risky investing strategy: By creating new DAI, buying ETH with it and using that ETH to create even more DAI you can create a geometric series to double or triple your initial ETH.

Personally, I don’t see value in that because the risk for a 30% drop in the price of ETH is significant. However the option to do so exists, and the Maker Platform is currently the most advanced decentralized system for that.

Conclusion – Is Dai a Good Stablecoin?

DAI is one of the most interesting stablecoin projects so far, and one I would personally love to see overtake Tether. If a transparent and credible coin like DAI was widely used, crypto critics would have less basis for their FUD.

In itself, there is little reason to invest in DAI, but it is important to understand the technology behind cryptocurrency projects to correctly judge their long-term value. If you understand a complex system like DAI, you are well set on your path to cryptocurrency investing.

Note by Roope:

I believe that stablecoins like Dai and Tether are great steps towards the mass adoption of cryptocurrencies. I believe that almost anyone who has invested in cryptocurrencies in the long term already in 2018 or before will make huge profits over the time course.

If you want to learn to make money with cryptocurrencies, take my step-by-step course on Udemy.

If you want to learn other ways to earn money online, take a look at the list of online jobs that I have collected for you. My #1 recommendation is Wealthy Affiliate for several reasons. Their step-by-step training is wonderful for beginners who want to learn the system to earn good money online. Their community and tools enable you to make your breakthrough. Click the picture below to learn more about it and get started for free.

What do you think about DAI?

Does DAI being quite complicated hurt its potential usage?

DAI vs. Tether, which is one better?

Let’s discuss in the comments below! 🙂

(Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice.)

Is Cryptocurrency Mining Still Profitable in 2018? Read This!

Those who started mining Bitcoin and have hold their rewards, have become now multi-millionaires thanks to the sudden rise of Bitcoin. Imagine that somebody earned $500 for mining when the Bitcoin price was only $1.Now that $500 would be worth $5-10 million.

But is cryptocurrency mining still profitable in 2018? Should you build or buy your own mining rig and start earning some passive income?

Cryptocurrency Mining Review – My Video on YouTube

In this article, I am going to answer your questions thoroughly and I’m happy you’ll find this helpfull. Let’s have a look!

What Is Cryptocurrency Mining?

With many cryptocurrencies including Bitcoin so-called ”miners” maintain the whole network and confirm the transactions. When you make a transaction, miners will confirm it with their equipment. In the other words, Bitcoin is a huge network of computers and CPUs all over the world that maintain the whole system.

Each 10 minutes miners get a small reward for confirming transactions and giving their capacity for mining. Some say that Bitcoins heart beats once every 10 minutes. Miners’ reward is pre-determined in the Bitcoin whitepaper and also with other cryptocurrencies.

This is how a typical cryptocurrency mining rig looks like.

With Bitcoin, for example, the mining reward is 1,800 Bitcoins per day. That amount is allocated between all miners all over the world.. The reward of miners halves next time in June 2020. Halving is always an important event for Bitcoin and in the past it has always raised the price significantly. Halving means that the miners get less rewards for mining which also means that there will not be so many new Bitcoins in the market.

Of course, the overall circulating supply is bigger but the number of new Bitcoins is then smaller. If the demand for Bitcoins remains the same, the price will naturally go up. It’s planned that in the whitepaper that in 2140 all Bitcoins have been mined and no new Bitcoins are issued anymore.

How Can You Do Cryptocurrency Mining?

Basically, there are 3 ways to earn money for cryptocurrency mining:

- Use your computer or current equipment for mining or build a mining rig.

- Buy a mining rig for example from Amazon.

- Participate in cloud mining.

The easiest way is probably to participate in cloud mining. In that scenario, you give money to somebody else who has already built a huge mining rig and your earn a little interest on your investment.

If you just use your computer or mobile phone for mining, your earnings are extremely small because the processing power is so minimal. Therefore, it isn’t even worth your invested time. So, then we would have two options: Either building your own mining rig or buying one.

One option is to build a huge mining farm but the downside is that it requires big initial investments.

Challenges of Cloud Mining

Cloud mining may sound like an easy money but I would like to discuss a few risks that are involved with cloud mining.

First of all, you need to be able to trust the company that takes your money. I believe have been many cloud mining scams over the years. The company has promised to give you an interest to your investment but they have just suddenly disappeared with your money. Your only option would be to try to find them and sue the company but it can be a lot of hassle and not so easy at all.

Second, with cloud mining, you are committing your money for a certain period of time. You don’t have control of your money during that time because the company is holding it. If you are investing in cryptocurrencies directly, you always have a control when you sell, buy or do something else.

Third, you may earn much more by just holding cryptocurrencies rather than investing in cloud mining. The history has shown that it’s possible to make even 10-100x returns on investments in a year by investing in potential cryptocurrencies.

Some exceptional situations have given even 1,000x profits in a year. If you would invest $1,000, that would turn in those scenarios into something between $10,000 and $1,000,000.

Of course, the history can’t guarantee the future but you still need to consider that you may earn more than holding rather than investing in mining. At least that has been the case in the past.

=> Want to Learn a Stable Way to Make Money Online? Learn More Here!

Cloud mining is often considered as an “easy way to make money” but the reality may be different.

Should You Build Or Buy a Mining Rig?

I have sometimes considering building a mining rig. I have a friend who makes $300 passive income per month for his mining rig and I have seen numerous people on the Internet showing their cryptocurrency mining and earnings.

However, so far I haven’t bought or built it myself and now I’ll explain you the reasons. I believe this will also help you to consider whether it’s’ worth building or not.

First of all, if you want to do cryptocurrency mining this way, you need to have money that you can invest money and time for the mining rig. If you build it yourself, it will take several hours to research how to do it, buy all the equipment and actually do it. I would say it takes at least 1-2 work days in total from a complete beginner.

The mining rig isn’t either very cheap. If you buy it, you may need to use thousands of dollars to get a high-quality equipment.

The #1 Reason Why I Can’t Do Cryptocurrency Mining!

Second, you need to find a place to do the mining. For example, Bitcoin mining is pretty loud and it can’t be done in your bedroom while you are sleeping. If you get a big mining rig, you also need to arrange a cooler for them because otherwise, it will heat up too much.

I am at the moment traveling around the world (Bulgaria-Macedonia-Turkey-UAE-Philippines-Malaysia, etc.) so I couldn’t even have a mining rig because I don’t have a permanent place to hold it unless I would hire someone else to take care of it. That brings me to the next point.

You also need to monitor your mining rig. Miners have told that the parts have broken sometimes and they needed to arrange new ones. In addition, mining also takes a certain part of your brain capacity, time and thinking because you know that it’s there. Of course, this isn’t a huge thing but still needs to be taken into account.

For example, I have an investment apartment in Finland and even though it doesn’t take almost at all my time or effort, it still takes a small amount of my time every now and then.

If I would do cryptocurrency mining, I would probably just buy mining rigs instead of building them myself. The time and effort costs money also because it’s away from some other activities. Nowadays buying a mining rig is easy because you can have one easily on eBay or on Amazon.

=> Get a Cryptocurrency Mining Rig for Just $379,99! (5/5 Star Reviews)

How Much Money Can You Earn for Cryptocurrency Mining?

Your earnings depend on the power you have in your mining rig. The more money you have invested for the better quality, the more you will earn.

Based on numerous miners that I have listened to, it takes around 6-10 months to break even with your initial investment. If you have invested, for example, $5,000 we can estimate that it will take 6-10 months that you earn it back unless something unexpected happens. This estimation is based on the assumption that the cryptocurrency that you are mining stays stable.

If the price goes up, you’ll earn your own investment back faster. If the price goes down, it will take a longer time to earn your initial investment. We also need to consider that you have invested time and effort for the mining rig. You could have used that time for something else that would have made your money during the same time.

In the other words, we come to a conclusion that it takes almost a year to earn back your initial investment and break even. In many cases that would be a huge return on investment. By investing in the stock market you can expect 8% annual return rather than 50% return per year.

Does money just fly from the sky with mining? Not really.

Conclusion – Is Cryptocurrency Mining Still Profitable in 2018?

The truth is that it can be profitable but there aren’t guarantees. You may make much better profits just by investing your money directly into cryptocurrencies. Spending money on building or buying a mining rig isn’t riskless

If I would live permanently in one place and I would have extra rooms, I could certainly consider mining. However, now when I’m moving around the world, I just prefer stick to investing.

There are several cryptocurrency projects that I have invested in and I believe they are going to give me awesome returns during the coming years. One of my favorite projects at the moment is Bankera and I’ve invested around $7,000 in their tokens during the ICO. Of course, there are also many other cryptocurrencies that I’ve invested in.

I’m also building passive income streams with the help of Wealthy Affiliate because I don’t want to put all my eggs in one basket. If you would like to learn more about it, I’m always happy to help you out.

If you want to learn the skills to make more money with cryptocurrencies, take a look at my newest course. I teach you a solid strategy that you can use for making money with cryptocurrencies in 2018 and beyond.

=> Learn to Make Money with Cryptocurrencies in 2018 And Beyond!

Have you been thinking about starting cryptocurrency mining?

Have you already done mining or do you have friends who are doing it?

Let me know in the comments below!

If you have any questions, I will be more than happy to help you out as always. 🙂

SuchApp ICO Airdrop Review – Don’t Miss This Chance!

Short version: Easy airdrop of SPS potentially worth about 2$ here.

SuchApp ICO Airdrop Review – What Is an Airdrop?

In an airdrop a token issuer or promoter offers free coins/tokens to participants. Some cryptocurrencies or tokens are completely airdropped instead of an ICO distribution, but mostly airdrops are used as a means to make a new project known to the world.

While keeping up to date on new potential investments to review here, I often stumble upon airdrops as well.

At the bare minimum to participate in an airdrop a user needs to give a valid ERC-20 compatible wallet address for the tokens to be deposited into (I suggest Metamask but Mist and MyEtherWallet are ok as well).

Sometimes participants are also required to join the project’s Telegram channel or leave their real name or email address for identification purposes. If an airdrop requires a participant to do active advertising on the behalf of the project on their own, for example writing favorable reviews or social media messages, the airdrop is called a bounty.

Unfortunately, many if not even most airdrops out there are phishing scams or empty promises, without an actual airdrop ever happening.

In December 2017 I went through a few public airdrop listing websites and found only three legit airdrops out of around 30 that weren’t bounties or scams. (One of them would have been worth 250$ (POLY)… And I failed to participate in it due to a cookie blocker on my browser being active…)

After that miserable experience, I haven’t used airdrop listing sites. Still, every time I stumble upon a legit airdrop while looking for profitable ICOs, I notify Roope about it. This time I’ll share one with you guys as well.

How Does SuchApp Airdrop work? – Video Instructions

SuchApp Airdrop

Project: SuchApp

Ticker: SPS

Product: Social media application with embedded cryptocurrency

Telegram cap: 12k/50k as of 18th February 2018

Airdrop requirements: ERC-20 wallet address, joining Telegram group, email confirmation

Airdropped amount: 21 SPS

Bounty: Yes, 20 extra SPS per referral

Post-ICO peak price prediction of token: 0.13$

Link to Airdrop: Link (referral link for Markus)

ICO start date: 26th February 2018

Airdrop date: 20th April at latest

Special notes: None

There you have it! Around 2$ might not seem much but it’s the best free money you can get in cryptocurrencies without any investments in real money! I didn’t deem SuchApp as a safe enough investment yet to warrant an ICO recommendation post.

84Still, this is a project I’ll be watching closely this July when they’ll release the beta version of the SuchApp social media platform. If this project is worth investing in, we’ll tell you in July/September!

Future airdrop posts will be much shorter than this because I won’t write the introduction about what airdrops are.

If you like this type of post, please say so in the comments below!

What Is Tether (USDT) And How Does It Work? Let Me Explain!

What Is Tether and How Does It Work? Is it really stable? Is Tether a scam?

Hundreds of thousands of people have been asking these questions all over the Internet so I decided to answer all of your questions in this article. If you don’t find an answer, you can always ask me anything in the comments below and I’ll be more than happy to help you out.

Tether Homepage.

Tether Review

Name: Tether (USDT)

Type: Cryptocurrency

Short Review: Tether is one of the most popular stablecoins in the cryptocurrency world. It keeps its value as close $1 as possible. It provides several benefits for cryptocurrency investors and traders but we need to remember that there are also a few risks.

Therefore, I don’t recommend holding Tether tokens for a long term in your crypto wallet. I recommend diversifying your crypto portfolio on coins that have a good long-term potential for growth like Bankera or Friendz.

If you are looking for a stable way to make money online, take a look at this step-by-step training. If you are wondering how you could make big money with cryptocurrencies, you might want to take my course here.

Is Tether Legit? – Video Review of Tether

What Is Tether And How Does It Work?

Tether is probably the most popular stablecoin in the cryptocurrency world. Being a stablecoin means that it’s supposed to keep always the same value which is $1. In the other words, Tether price is designed to have the same value as USD. When you give them one $1, they give you one Tether token.

Tether differs from other cryptocurrencies in a way that it’s a centralized company. Most other cryptocurrencies (excluding Ripple) are decentralized. The company says that they have enough dollars to back up the whole Tether market cap. They say it’s 100% backed. However, there has been some controversy about this that I’ll discuss further.

Tether price stays always as close $1 as possible.

Benefits of Tether

First, let’s talk about the benefits of Tether and then I’ll discuss a few risk and challenges.

1.No Taxes

When a bear market is coming, many people would prefer changing their cryptocurrencies into fiat currencies because they are more stable (bear market means that the prices go down).

However, in many countries, you need to pay taxes when you exchange your cryptocurrencies into fiat currencies with profits. For example, in Finland (my home country) people need to pay 30-33% taxes on their profits. If you made $10,000, profits, and exchange your cryptocurrencies back to euros, you would need to pay $3,000 taxes.

Now Tether provides a wonderful option. When you exchange your

2.Tether keeps you safe when you want to quit the market for a while

When following cryptocurrencies, have you ever felt that some coin has grown a bit too much? Or there has been a long bull market (prices going up) for so long time that soon prices must go down again?

Then you would probably like to take your money out of the market for a while and buy back when everything is on the bottom. Of course, nobody can know for sure when we’re at the top and when we’re at the bottom but we can always make predictions and do our best to maximize the profits in the market.

3.Tether can make trading more practical

Several big crypto exchanges including Binance and Bittrex use Tether (USDT). Traders can easily change their cryptocurrencies from one to another by using Tether in the middle. You can’t usually exchange two rare alt coins between each other.

Let’s say that you would like to change your Tron coins into Cardano. You first need to change Tron into BTC, ETH or USDT and then some of those coins into Cardano. With USDT it can be pretty easy and there isn’t volatility between the trades.

=> Want to Make Money with Cryptocurrencies in 2018? Learn Here!

Risks And Challenges of Tether

Many people have recently been pointing out the flaws and challenges of Tether. Let me explain the reasons for people’s concerns.

1.Does Tether really have all the money?

As I explained above, Tether promises that all funds that they receive, are 100% backed up by their own dollars. However, there aren’t guarantees whether they really have it or not

Tether shows on their website dollar and euro amount that they have but who can confirm that they really have what they are saying?

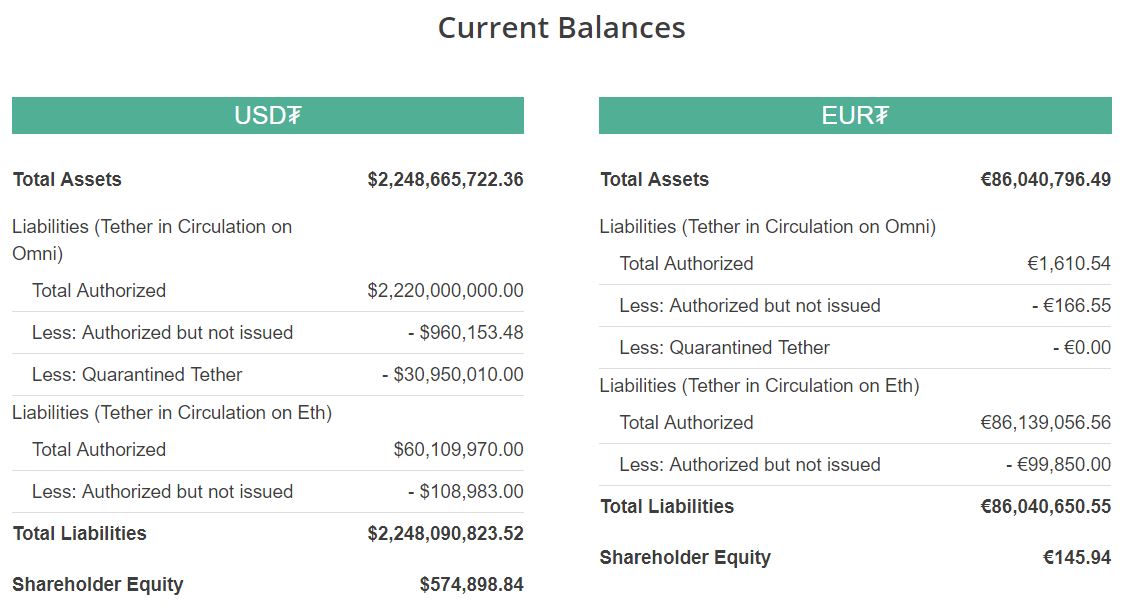

Tether shows these amounts on their website. (And updates them regularly).

The problem arises, for example, when most people who own Tether would sell their funds. Would 90% Tether owners sell their tokens? Well, it’s possible even though it’s unlikely to happen. But we must admit that in theory, it’s possible if something unexpected happens.

2.What if…

Some people have been asking what would happen if everybody who owns Tether would sell their tokens at the same time. Would the whole crypto market crash? Recently I read an article how a crypto “expert” how Tether can crash the whole crypto market.

In my opinion, this is not a possible scenario at all. Tether market cap is usually way less than 0,5% of the total market cap of cryptocurrencies. How could it crash the market? The crash of Bitcoin or Ethereum would certainly cause effects to the whole market but I think that the Tether crash wouldn’t be so significant. There are some other stablecoins anyway.

3.Controversy with Bitfinex

In February 2018 there has been quite a lot of controversy around Bitfinex and Tether. People have been asking whether those two are the same thing because they seem to have connections between each other. I don’t know all the details of this issue but I know it’s one reason why Tether raises concerns among crypto investors.

My Personal Thoughts on Tether

I believe in the bright future of cryptocurrencies. They would bring numerous benefits for humans that I’ve discussed in my other articles and YouTube videos. Therefore, I think that all improvements and even attempts for improvements are good because they move the overall development forward little by little.

In my opinion, it’s good to have options like Tether. It gives more options and opportunities for the whole cryptocurrency world. I believe that each step we take with cryptocurrencies is a step closer to a world where we rather use cryptocurrencies rather than government money like $, € or £.

Will we solely use cryptocurrencies in 2040?

Conclusion – Is Tether Worth Buying?

Holding Tether itself doesn’t make you any profit. It just keeps your crypto balance stable compared to USD. But as we know, the value of USD or any other fiat currency usually goes down over the time course. Especially compared to the cryptocurrencies, fiat currencies are losing their value all the time. Therefore, holding Tether is only a temporary situation. You don’t want to hold them for a very long time, in my opinion.

In addition, I see Tether riskier than USD in some aspects. The price of USD stays pretty much the same even though it slightly goes down but at least you have the money (usually) that you put to your bank account. Cryptocurrencies are still very unregulated and there’s some risk of holding Tether. Have they backed up the whole market cap? What if people sell their Tether tokens? etc.

That being said, you can benefit from Tether if you are able to predict market crashes and rises. When the bear market starts, you sell your Bitcoins, Ethereums, and others into Tether and when we have hit the bottom, you buy cryptos back again. You avoid taxes and another extra hassle that comes with fiat currencies.

Before we wrap up, I would like to remind that any investing involves risk. You can either win more money or lose money. You should always be careful and stay up to date when it comes to cryptocurrencies. I enjoy investing in cryptocurrencies for several reasons but I also like building more stable income streams.

If you would like to learn to “proven” ways to earn money online, just follow this step-by-step training or click the picture below. I call them proven because thousands of people have used this same method over and over again. I have found out in my own life also that it pretty much always works.

What do you think about Tether?

Is it worth buying or not?

Is Tether reliable or not?

Let’s discuss in the comments below! 🙂

(Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice.)

Is Status a Good Investment? Read Why I Preferred It!

What Exactly is Status? Is Status a Good Investment? How Much Money Should Invest in Status for a Start?

If you have been asking yourself such questions, this is the right place for you to get the correct answer. In this article, I will be discussing Status to help you know how it works. You will then Be Able to Make a Sound Decision on Whether to Invest in It or Not.

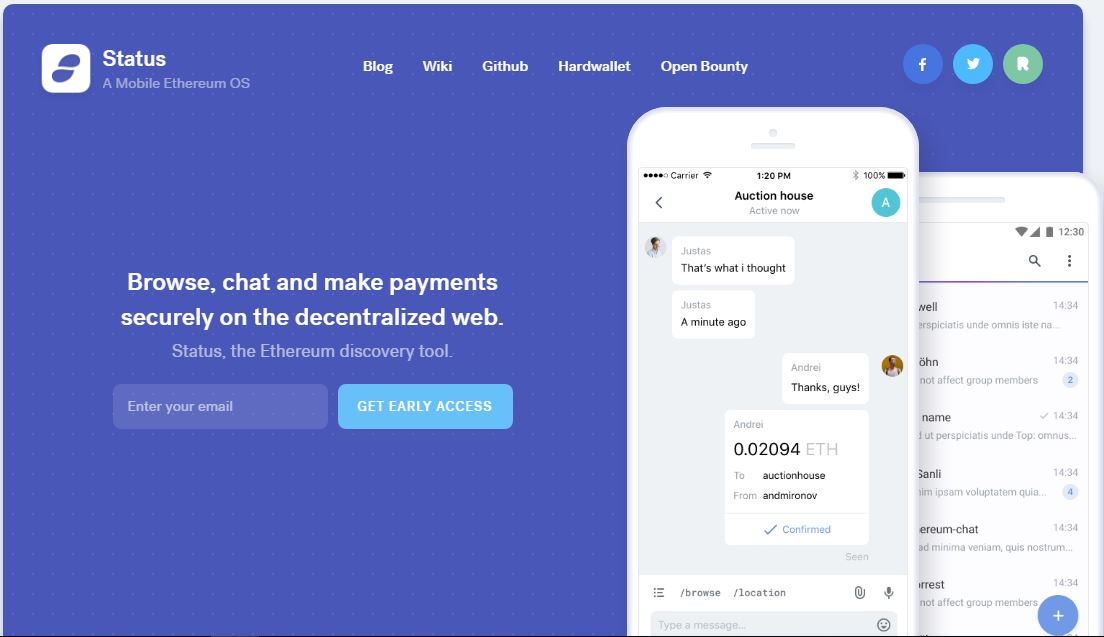

Status Homepage

Status Review

Name: Status

Launched: 2017

Type: Cryptocurrency

Short Review: Status is a messaging platform that runs on Ethereum network. Status makes your mobile device a light client node on the Ethereum network, making it possible for you to access the whole Ethereum ecosystem despite your location. With Status, you can send payments to your friends from within chats.

That seems very exciting and Status is certainly an interesting project to follow. Meanwhile, if you also enjoy proven and guaranteed ways to make money online, I recommend taking a look at this step-by-step training. It will also boost your income with cryptocurrencies.

What Is Status?

Status is a platform for decentralized applications and its cryptocurrency is known as Status coin (STN). The platform is simply a light client for Ethereum that serves as a browser, messenger ad gateway. This means that Status platform is based on Ethereum blockchain. On the Status platform, users are allowed to design their apps through smart contracts.

Status is connected to Ethereum peer-to-peer network, hence it is capable of exchanging data through this decentralized network. You can program your decentralized application on the Status platform. The major goal of this decentralized platform is to enhance accessibility by allowing the public to be able to use Dapps and cryptocurrencies on their smartphones.

How Does Status Work? / Benefits of Status

The Status platform can be seen as a community project working on an open source system. Anyone can participate in the network provided they are willing to do so. This is why Status can be seen as a form of social media platform. You can send, receive and save Ether as well as other cryptocurrencies via the Status platform.

Status comes with eWallet. The uPort ID is an app that is based on Status. The app allows you to use its encrypted and mobile identity for securing digital interactions. Etherisc is also another app based on Status, which is a platform for decentralized insurance. It has made the sale and acquisition of insurance policies cheaper, efficient and more transparent.

Status works on a decentralized economy, but it is in need of playing a great role in the social media sector. It is an encrypted messenger that can be used for sending and receiving Ether, completing smart contracts and chatting. It is based on a peer-to-peer protocol. Its cryptocurrency, the Status coin serves as the token on the platform.

Status provides smarter private messaging.

Other than being a messaging platform, Status is a mobile Ethereum operating system. This means that it can engage with the other decentralized applications (Dapps) running on the Ethereum platform. Status has adhered to the concept of blockchain technology by giving users complete control over their data on the network. It is a crypto-coin that can make lives easier, hence it has a lot of potential.

With the Status platform, many people are able to work with the Ethereum blockchain without necessarily having to download it completely. Ethereum works under proof-of-work algorithm, in which miners work by solving complex cryptographic puzzles. This is to be replaced by the proof-of-stake system, in which voting will be based on the number of tokens one owns as well as the amount of computing power they contribute to the network.

Status is expected to introduce a “smarter private messaging” with an additional functionality like smart contracts and payments. A protocol is used for encryption of all communications. This way, users are able to exchange ideas, services, and currencies with no problems. This means the success of Status will depend on the accessibility of decentralized applications.

Risks of Status

Currently, the only risk facing Status is that it relies on the Ethereum blockchain. It is simply a light client for Ethereum, providing users with an easy way of using the Ethereum platform. If Ethereum falls, Status may have big challenges.

However, Ethereum is a very promising platform since it provides developers with all tools necessary for the development of decentralized applications. Ethereum is expected to overtake Bitcoin and it is not expected to go down. The success of Status relies on how Ethereum does in the market.

=> Want to Learn to Make More Money Online With/Without Cryptocurrencies? Learn Here How Roope Did It!

Status Team

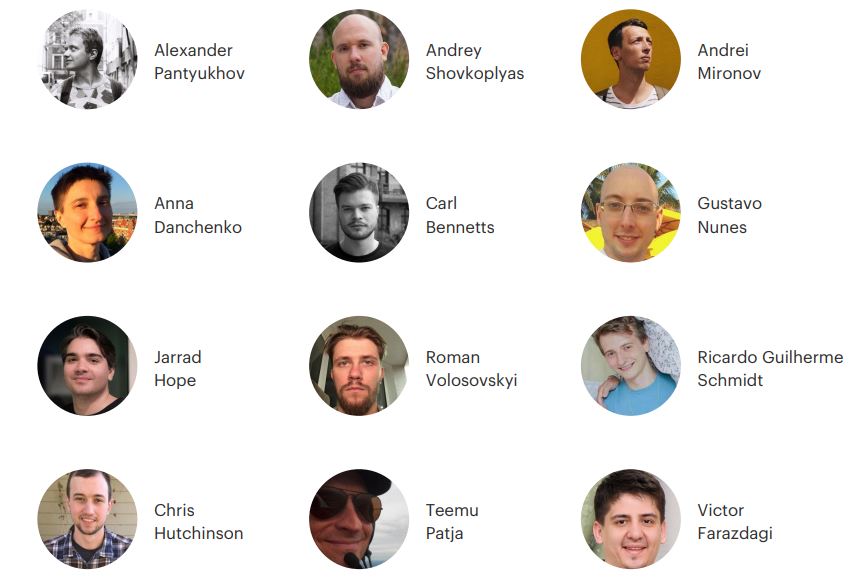

The development team has about 12 members plus 10 advisors. The following are the core contributors of Status:

- Jerrad Hope: He is the Leader and Co-founder of Status. He had previously founded Opulence, which is a software distribution network which later grew $20M revenue within 30 months.

- Carl Bennetts: a co-founder and head of Communications & Marketing. He was also a co-founder of Opulence.

- Roman Volosovskyi: He is a developer, having specialized in Clojure (a general-purpose programming language). He has also worked with Symphony2 as a developer and ZEO Alliance as a Software Engineer.

- Alexander Pantyukhov- a Java, Android, and VClojure developer.

Status Team Members

- Andrey Shovkoplyas- a Clojure developer. Previously worked with Reasoning Mind as Software Development Manager and Dadcan as CTO.

- Gustavo Nunes- Clojure developer.

- Victor Farazdagi- a Go developer. Previously Software Engineer at Carrierwave and CTO at Square Las.

- Andrei Mironov- User experience and visual design expert.

- Anna- the Head of QA. She has previously worked as Senior Tester at SDL Web and Senior Tester at SDL Web.

- Tatu- the Community Manager.

Status Community

Status was developed by Status Research & Development GmbH, which is a company based in Switzerland. The development team is active on Slack and GitHub. Below are social media metrics about Status:

- GitHub: 35 contributors, over 1400 commits,

- Slack: over 8300 users,

- Twitter: over 6100 followers

- Reddit: over 760 redditors

- Facebook: over 1900 likes

- YouTube: over 900 subscribers.

As you can see, Status has a large community and

Is Status Worth Buying?

Personally, I will say Yes. With Status, life can be made much easier. This is what people have been looking for when using cryptocurrencies. They need an easy way of exchanging coins and communicating with other users on the blockchain networks. If people can get such a platform, they will adopt it straight away. Status has fulfilled, hence there will be increased adoption of this cryptocurrency.

Most people like the Ethereum platform. This has seen the value of Ether rise to compete with Bitcoin, almost overtaking it. Status is based on the Ethereum platform and facilitates an easy exchange of ether. Status will benefit from the increased adoption and use of the Ethereum platform.

With an increase in the adoption of Status, the value of Status coin (STN) will rise. This is why I believe that Status is a coin worth buying. The status platform is also competing with messaging platforms like WhatsApp, WeChat, and Line. It provides an easy to use interface where users can chat and send payments to each other.

Status has all the features that any cryptocurrency lover will want to experience. A Status user can easily find the nearby users whom they can exchange cash for currency and digital assets with. It gives all smartphone owners the ability to control their wealth. The Status can be used on mobile devices running either Android or iOS operating systems increasing its accessibility and providing chances for its increased adoption.

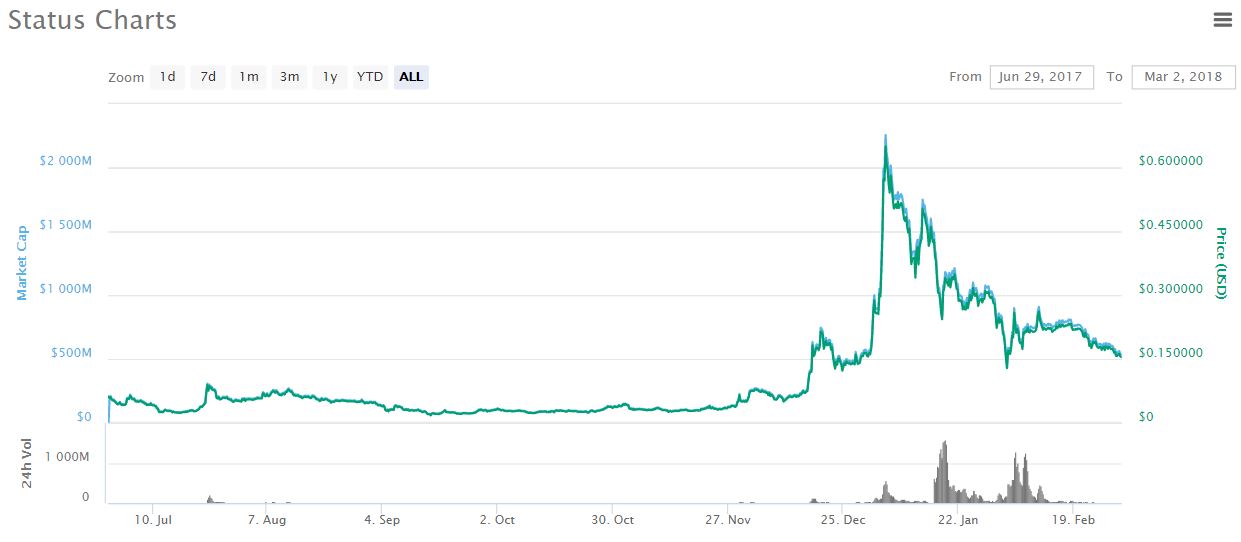

Status Price Prediction

STN is a coin to watch with its price expected to increase. The Status price equals to 0.199 USD as at 2018-02-22. In case you buy Status for $100 today, you will be given a total of 501.266 SNT. A long-term increase in the price of Status is expected, with the price prognosis for 2023-02-17 being 3.281 US Dollars.

However, that’s only a prediction of one man and there are not any guarantees for such growth. For a guaranteed money-making opportunity, I recommend just going through this training and applying it into practice.

Status price multiplied 10 times at the beginning of 2018 but since then it has been going down, down and down. Do you think that the trend will change? Let me know in the comments.

Conclusion – Is Status a Good Investment?

I can still say that Status is a good investment opportunity, in my opinion. If Status competes successfully with WhatsApp, WeChat, and Line, its value will increase significantly. There is going to be a MASS adoption of Status in the near future, and this will contribute significantly to its predicted rise in price.

Are you looking for a way of earning good money online? Are you looking for a digital currency to invest in? I will advise you to consider Status. The sky is the limit for this cryptocurrency. Status is also owned by Status Research & Development GmbH, a company based in Switzerland.

But as you and I know, anything can happen. The price jumped 10 times higher at the beginning of 2018 but since then it went back to the old price. Volatility is humongous and it’s hard to say what happens in the short term. That’s why you should follow these principles to make money in the long term.

As I mentioned above, investing money in cryptocurrencies always involves risks. That’s why I recommend that you build multiple online income streams. You can learn our #1 recommendation by clicking the picture below:

What is your Opinion about Status?

Will you Invest in Status?

Why or Why Not?

I Will Be Happy to Hear Your Opinion!

Let’s discuss in the comments below! 🙂

(Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice.)

Is Icon a Good Investment? What you MUST Know!

There are many cryptocurrencies in the market but I developed a sort of love for ICON (ICX) at first sight. I feel it is a cryptocurrency worth your investment.

What is ICON? Is it worth Buying? How does it Work?

This is the best platform for you to get answers to any questions you have about ICON. In this article, I will help you understand ICON better before investing into it. Take your time to read this article and know how to succeed in ICON investment.

Is ICX a Good Investment? – Roope’s Video Review

ICON Review

Name: ICON (ICX)

Launched: 2017

Type: Cryptocurrency

Short Review: Imagine having a cryptocurrency capable of bridging public blockchains such as Bitcoin, Ethereum, NEO and Qtum? This is possible with ICON. It is a cryptocurrency that comes with a new Consensus Algorithm named LFT (Loop Fault Tolerant). To know how this works, take a closer look below!

Disclaimer: Investing in cryptocurrencies always involves risk. If you are looking for more “secure” ways to make money online, we recommend having a look at this step-by-step online business training.

ICON homepage is futuristic but simple.

What Is ICON?

ICON has been designed to be a big scale ecosystem, allowing different blockchain protocols connect to each other via their protocol. It is an online ledger on which institutions such as banks, security firms, universities and private blockchains are able to share their information without relying on an intermediary.

This feature is not offered by other blockchains, hence institutions MUST invest in ICON and enjoy this feature. In ICON, consensus can be reached faster as a result of use of LFT protocol without having forks. This is a feature that financial institutions such as banks have desired to have, making ICON a very promising cryptocurrency in terms of adoption.

In LFT, a fast consensus is reached by creating a group amongst the trusted parties. ICON owner, TheLoops partnered with some leading financial institutions providing them with services like settlement systems with no intermediary agencies, common authentication systems and real time trade systems.

How Does ICON Work? / Benefits of ICON

ICON is a blockchain of blockchains, allowing communities such as hospitals, universities and banks to create their own blockchains. Each blockchain that operates under ICON is autonomous from the other blockchains, and it is connected to the ICON global blockchain system. There are some nodes on the network that act as liasons between the individual blockchains.

This has been achieved by use of loopchain technology. Most blockchain technologies are geared towards being scalable for widespread and widespread use. Currently, only ICON is providing a blockchain protocol that is scalable for a worldwide adoption and a number of industries, institutions and businesses are using it.

The current users of ICON are expected to expand their networks and the usage of the cryptocurrency, and other businesses and industries will follow suit. Currently, ICON has a market capitalization of US$2.7, but this is expected to grow to overtake that of its competitors like Ethereum or NEO.

ICON can be used in companies of any size. The goal of ICON team is to have the largest decentralized network connecting countries and people across the world.

It can work well with blockchains such as Bitcoin, Ethereum and others. ICON works well with third-party blockchains connected to the world. This way, ICON helps connect the real world to the crypto-world, creating new opportunities for businesses.

ICON has increased the usability of Blockchain. The goal of ICON is to be highly usable and make the blockchain technology usable in daily lives. The team has created real world applications that can be used by businesses and communities. It features DAVinCI, an artificial intelligence solution many financial institutions need to use.

=> Want to Make Money with Cryptocurrencies? Learn More Here!

Risks of ICON

Every type of investment is associated with some risks and ICON is not different.

Icon interacts with the public via smart contracts. The designers rely on Bancor protocol whose pricing equation is flawed. This protocol has a low liquidity on small currencies.

The ICO suffers a threat from the changes in the price of Ether. If the price of Ether increases steeply, the ICON holders may destroy their coins via the contract. The reason is simple, the contract will have a high worth compared to the coin, meaning that everyone will have to sell the coins to the contract.

Also, Ether has not become stable as we speak. There is a risk when you tie your currency to any unstable one. Consider the Insurance and Hospital as an example. Suppose the value of Ether decreases by 15% in one day, the Hospital community that had received ICX from the Insurance company will feel to have been cheated.

For the case of the average investors, there is risk for you if you hold this token since it is of no use to you if you have no one to sell it to. Also, even if this token is supplied in huge amounts, it will be of no help. Many companies will be expected to use blockchain services so that a real demand may be generated.

ICON Team

There are several organizations involved in ICON, including ICON Foundation, which is a nonprofit organization in Switzerland. ICON has a large team including many advisors, each with some connections that will help popularize this technology across the world. YG Lim leads the Asian product development team.

YG Lim is also working on a number of other blockchain projects. There are large ambitions

ICON’s strong team of advisors.

associated with this project, and this is expected to draw in more team members.

TheLoop, which is a company headquartered in Korea is also part of ICON team. The company is responsible for developing smart contracts and ICON Nexus. Finally, DAYLI Intelligence is responsible for providing DAVinCI, the artificial intelligence solution for optimizing the distribution and the network.

The ICON team includes eight advisors, 13 people in blockchain department, six members of the foundation council, five in AI department and other five team members responsible for design, marketing and security.

ICON Community

ICON has its headquarters in South Korea, but its popularity has spread out across the world. European and Asian countries are the leading investors in ICON. It is true Bitcoin and Ethereum are the leading cryptocurrencies in the world.

However, ICON is very promising and if its development team delivers on its promises, there are high chances it will become the leading cryptocurrency in the world, overtaking Bitcoin and Ethereum.

The goal of ICON is to connect the world on a global level and enable all blockchains to interact with each other. Many institutions across the world are beginning to adopt ICON. Examples include banks, hospitals and academic institutions.

Is ICON Worth Buying?

ICON price hit its peak in 30th of January in 2018. (Blue line shows the market cap, Green line the price in USD and the orange line shows the price in BTC.)