Maker Token Review (MKR) – Can You Make Money?

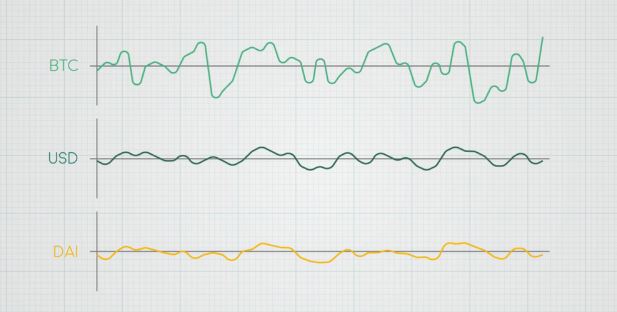

In my last article, I reviewed the DAI stablecoin. The Maker Token (MKR) is a stellar example of a functional token. The token holders govern the Maker system and their actions affect the price of MKR. Read on to discover more.

Maker Coin Review – Will Maker Hit $4,000 in 2019?

Take a look at my YouTube video to learn more about Maker.

Maker Review

Name: Maker

Ticker: MKR

Launched: 23th August 2015

Type: Cryptocurrency, ERC-20 token

Short Review: The Maker Coin (or Maker Token) is an investment into the Maker Project. Ownership of MKR permits taking part in the maintenance of the Maker projects, like the stablecoin DAI and the ecosystem around it. The value of MKR is based on the successful maintenance of the projects and use of the products.

Maker is an interesting token and may give great returns in the future if Dai/MKR projects succeed. On the other hand, investing in cryptocurrencies always involves risk. If you want to learn a more secure way to earn money online, have a look at this step-by-step training.

What Is Maker and How Does It Work?

What Is Maker and How Does It Work?

In a previous article, I explained the DAI stablecoin, valued at 1 USD. I recommend reading that article first, or the terminology used here might be confusing. The parameters for DAI generation are set by holders of the MKR token via vote. The parameters include but are not limited to:

1. Target Price

The target price of DAI is currently set at 1 USD.

2. Target Rate Feedback Mechanism

MKR holders vote on the Target Rate and the Sensitivity Parameter. They can also disable TRFM altogether, keeping the Target Price locked.

3. Risk Parameters

The Risk Parameters for the currently available CDP is set at 150% collateral for every DAI generated. The MKR holders can vote to allow users to create more risky CDPs (less collateral per DAI) or alternatively require more collateral per DAI. The Risk Parameters also include the fees users pay when their CDP is closed due to prices dropping or paying off the loan.

4. Global Settlers

MKR holders appoint and determine how many persons are required to trigger a Global Settlement, a last-resort stability mechanism, for the Maker Platform.

Benefits of Maker

What is the benefit of owning MKR? How will the price go up?

1. Closing CDPs destroys MKR

When a user closes a CDP by destroying an amount of DAI equal to the amount they created using it, they have to pay a small interest fee issued in MKR. This MKR is destroyed, thus reducing the supply of MKR and increasing its price.

As the demand for the DAI stablecoin increases, users keep creating new CDPs and eventually close them to regain their collateral. The more popular DAI becomes, the more MKR is destroyed as interest fees, increasing the price of MKR.

2. Floating price on exchanges

MKR is an ERC-20 token that can be traded on exchanges. Like most tokens, the price of MKR floats according to supply and demand. This makes MKR a viable long-term investment, unlike DAI.

Risks of MKR

There are also mechanisms that cause the value of MKR to drop.

1. Automatic recapitalization

If the collective collateral pool becomes less valuable at some point than the total amount of DAI in circulation, the system creates new MKR and sells it to fill the collateral pool. This dilutes the supply of circulating MKR, decreasing its price. Ultimately this means that the MKR holders are responsible for keeping DAI sufficiently backed and have to pay if it becomes undercollateralized.

2. Hacking

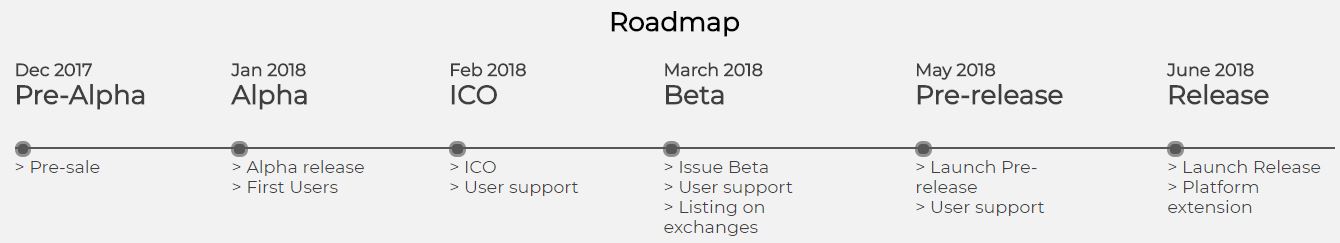

Even though the project is over 2 years in making, they still list malicious attacks on their smart contracts as the primary threat to the system. The project aims to combat this via external security audits and formal verification of the smart contract code. Looking at the roadmap and other ongoing work, this does indeed seem to be the case.

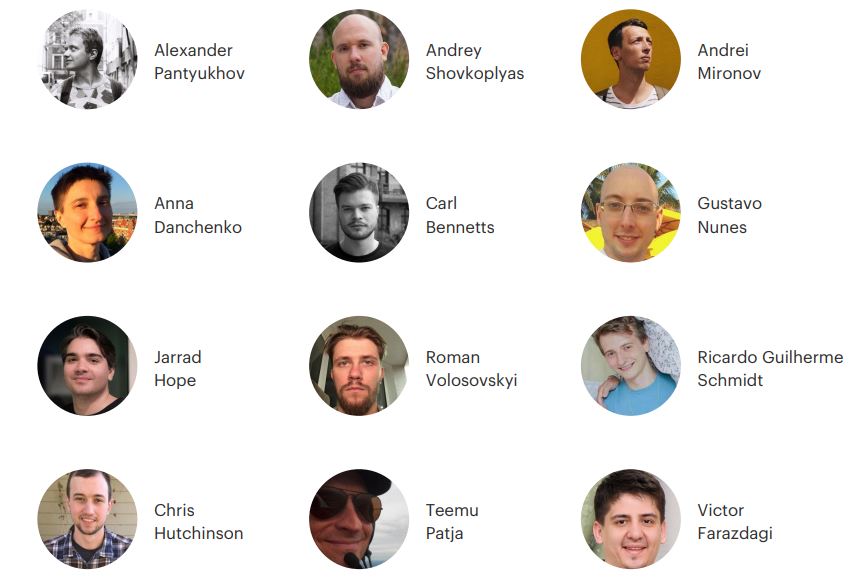

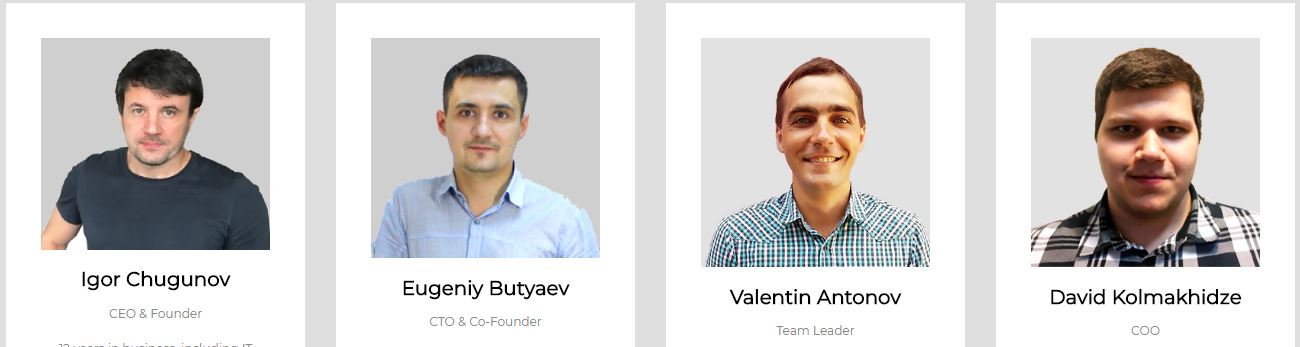

Maker Team

There are 44 people currently working on the MKR project. The sizeable team has done a good job with transparency. They hold weekly voice calls with MKR holders to describe progress and debate changes. In the picture below you can see the leaders of Maker team.

Maker Community

Reddit: 3k

Twitter: 6k

Rocketchat: 3k

The community is active and a significant fraction of it is interested in the development and maintenance of the product. This token is highly technical and as such the userbase would seem to attract blockchain experts and veteran investors.

Is MKR Worth Buying?

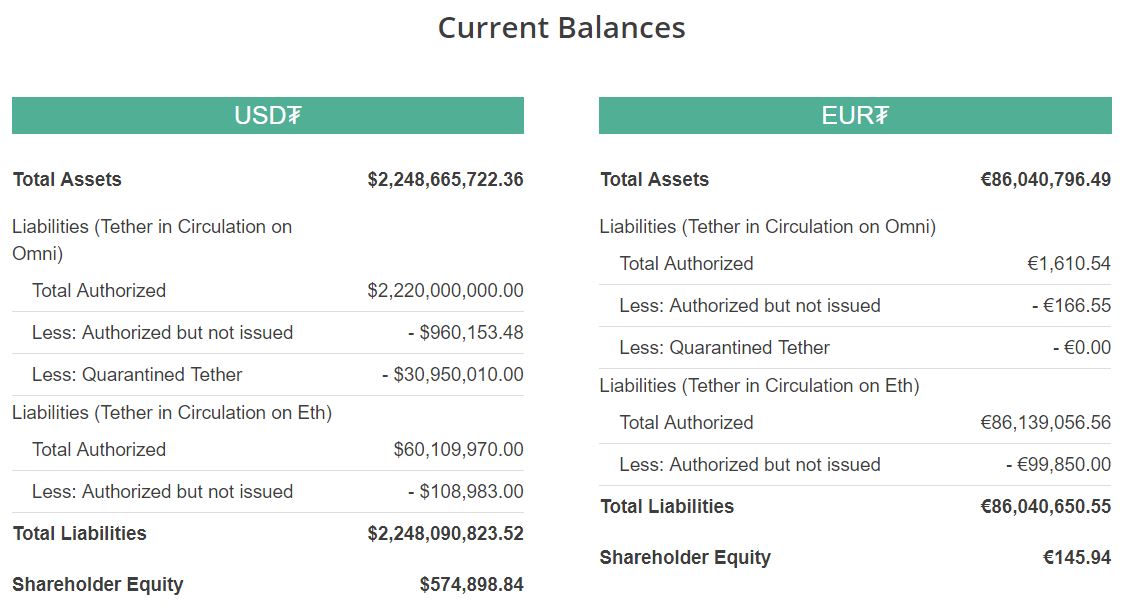

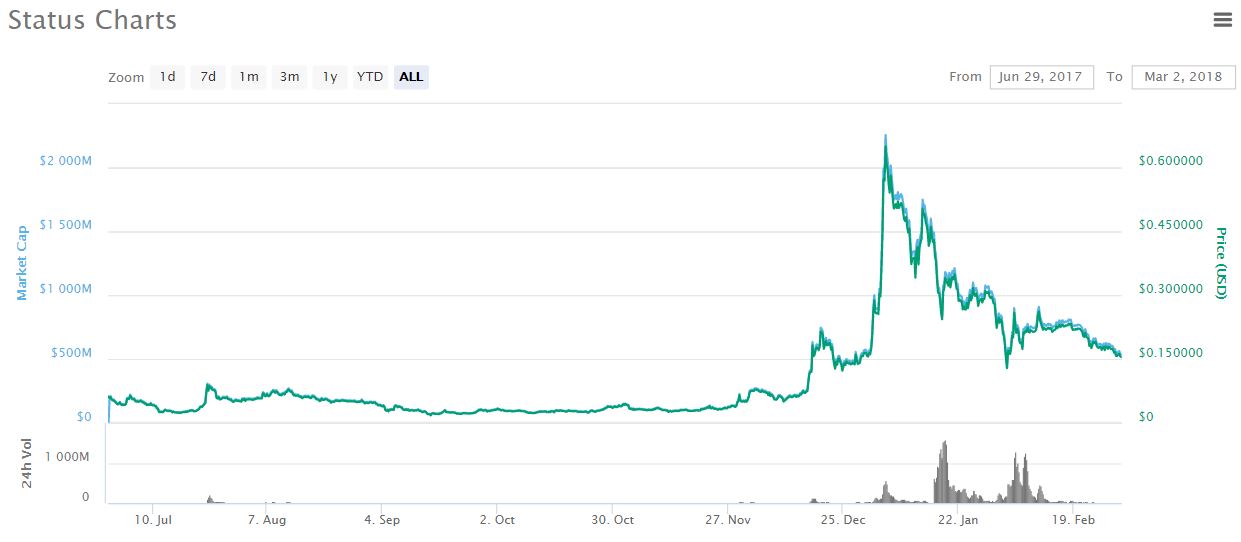

DAI was released in December 2017. The price of MKR has almost doubled since then. We can expect a significant increase in users when multi-currency CDPs become available. If more cryptocurrency exchanges begin to use DAI instead of Tether like the Bibox exchange has already done, MKR will benefit.

Maker Price Prediction 2018?

I predict mostly speculative price action for MKR in 2018. The current CDP volumes, while significant, are not enough to affect the price of MKR. That said, I predict that the FUD surrounding Tether will benefit DAI and MKR. Additionally, huge news like a major exchange listing can spike the price up. Finally, MKR benefits from any bullish trends in ETH.

2018: Short periods of 1500$ – 2000$ price range, unable to break 2000$.

2019: Overthrowing Tether combined with bullish ETH for 4000$-5000$, otherwise steady growth towards 3000$

Conclusion – Is MKR a Good Investment?

MKR is an exceptionally complex and risky token. Overthrowing Tether as the leading stable cryptocurrency is a gargantuan task, but the solid technology behind the project makes this a viable goal. Unlike many other tokens, whose value is mostly speculative, MKR has a ready product (DAI) and a clear, transparent system in place connecting the investor token with the product.

I see MKR as a reliable investment even at the current quite high price. However, even more so than usual, I urge you to understand this complex token before investing in it. Staying up to date with the project and predicting major releases by participating in the weekly calls will allow you to stay ahead of the game and move before the market does on MKR.

This token is especially good for purchasing dips. If bad news like hacking or a Global Settlement happens, the price can drop a lot, only to recover later due to the stable demand for DAI generation.

(Note by Roope):

Maker is certainly an interesting cryptocurrency and I consider investing in it in the future. I think that stablecoins are a great step forward when moving into mass adoption of cryptocurrencies. Many people want that the value is predictable and doesn’t move up and down 20% in a day.

That’s why I believe that coins like Dai and Tether may have a great future. It means also that MKR could potentially go up significantly in value.

I am holding the most of my money in cryptocurrencies and they have given me great returns over the years. If you want to learn how I make money with cryptocurrencies, take a look at my step-by-step course on Udemy. I share it for 95% for my website visitors and social media followers.

While I am holding cryptocurrencies, I am building additional income streams with affiliate marketing. If you would like to enlarge your online income or cryptocurrency portfolio, take a look at the step-by-step training below that has took me from a complete beginner into a professional affiliate marketer.

You can also use those steps for making more money with cryptocurrencies.

What do you think about MKR?

Do you think exchanges will move from Tether to DAI?

Do you think hacking is a risk for tech-heavy projects like MKR?

Is MKR worth buying or not?

How much will the value be in the future?

Let’s discuss in the comments below! 🙂

(Disclaimer: The above references an opinion and is for information purposes only. It is not intended to be investment advice.)